The Truth About the 2/1 Buydown: When It Makes Sense—and When It Doesn’t

In today’s real estate market, you may have heard your lender or agent mention something called a 2/1 buydown. It’s often pitched as a way to “save on your mortgage” for the first couple of years—but is it really the right move for you?

Let’s break down what a 2/1 buydown is, when it can make a lot of sense (especially when sellers offer it), and when you're actually better off skipping it and putting your money to work elsewhere.

What Is a 2/1 Buydown?

A 2/1 buydown is a mortgage financing arrangement where the interest rate is reduced by 2% in the first year and 1% in the second year, before returning to the full rate in year three.

For example:

If your full mortgage rate is 7%, you’ll pay:

5% in year one

6% in year two

Then back to 7% starting in year three for the life of the loan

The cost to make this happen is paid upfront—usually by the seller as an incentive to help you close, or in some cases, by the buyer themselves.

When a 2/1 Buydown Makes Sense (Seller-Paid)

✔️ The Seller Covers the Cost

If the seller is offering to pay for the buydown as part of your negotiation package—take it. It’s essentially free money that reduces your housing costs temporarily, giving you some financial breathing room as you settle into the home.

✔️ You Expect to Refinance or Sell in 2–3 Years

If rates are high today and you plan to refinance when they drop—or if you expect to sell or relocate before year three—you may never have to pay that higher final rate at all.

✔️ Cash Flow Is Tight in the Short Term

If you’re stretching to afford closing costs, moving expenses, or furnishing the home, a 2/1 buydown can temporarily ease the monthly burden.

When It Doesn’t Make Sense (Buyer-Paid)

🚫 You’re Paying for the Buydown Yourself

If you’re coming out of pocket to fund the buydown, consider this: the money you’re spending upfront could actually work harder for you elsewhere.

Let’s say the buydown costs $8,000. Instead of giving that to the lender, you could park that money in a high-yield savings account earning 3–4%. Then, withdraw just enough each month to “subsidize” your payment during those first two years—essentially creating your own 2/1 buydown, while keeping the remaining funds accessible and growing.

It’s a smarter way to maintain flexibility, keep your liquidity, and earn interest—especially in today’s high-yield environment.

🚫 You’re Planning to Stay Long-Term Without Refinancing

If you’re not planning to refinance, that temporary rate relief ends after 24 months. You’ll be left with the full rate anyway—plus you’ve already spent money to delay the inevitable. Better to get comfortable with the full payment from day one or negotiate a permanent rate buydown instead.

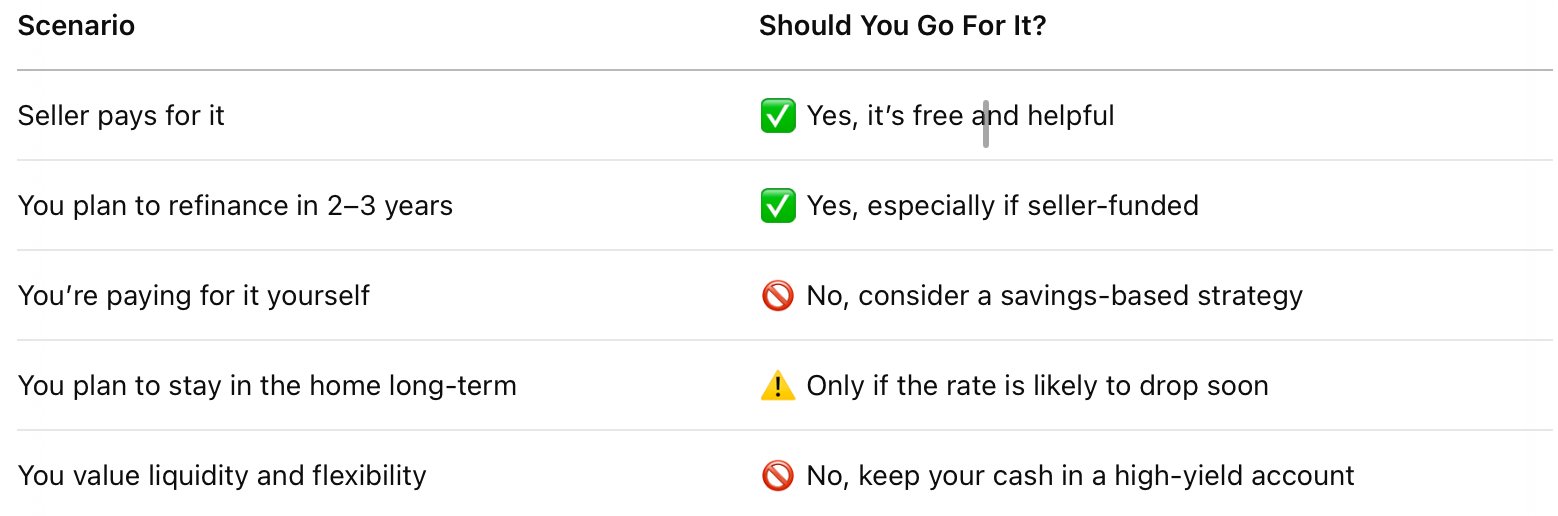

Quick Recap: When to Say Yes or No to a 2/1 Buydown

Final Thoughts

At The Ownrs Club, we believe in helping you own smart. A 2/1 buydown can be a great short-term strategy when it’s someone else’s money, but if you’re footing the bill, you might be better off creating your own version with a high-yield savings account.

Want help running the numbers on your next mortgage or negotiating seller-paid incentives? Let’s talk. Our team is here to help you make decisions that keep more money in your pocket and help you build real, long-term wealth.